The global military generator market was valued at $1.3 billion in 2021. According to a new report by Allied Market Research, the market is projected to grow to $2 billion by 2031. This growth reflects a compound annual growth rate (CAGR) of 4.7% from 2022 to 2031.

In 2021, North America led the military generator market. This dominance is mainly due to the United States’ high military spending. The U.S. invests heavily in acquiring and developing advanced military systems. It is also a global leader in applying modern technologies across the military, navy, homeland security, and other defense agencies. The U.S. Department of Defense (DoD) had an annual budget of $721.5 billion in the fiscal year 2020. This amount was 5.2% higher than the previous year. The U.S. Army is focusing on modernizing its defense infrastructure, which includes installing advanced military generators.

Other developed and developing countries such as the UK, India, China, Russia, and the U.S. are also increasing their spending on military power equipment. They aim to strengthen their emergency energy sectors. For example, in September 2021, the U.S. Department of Defense signed a $3.67 million contract with Enginuity Power Systems to develop new hybrid generator technology. Such government investments are expected to boost the market during the forecast period.

Advances in air defense technology, improved security measures, and stronger weapons and missile systems are key factors driving growth in the military generator market.

One important product type is combination light towers with generators. These mobile outdoor lighting systems provide strong illumination in many environments. They range from small portable units for minor work sites to large mobile towers that can light up to 10 acres. Manufacturers can customize these light towers to meet customer needs and provide maintenance services. For instance, Alaska Defense created the Alaska 1,000-Watt Portable Light Tower (1KPLT). This compact unit provides portable lighting for up to 10 hours, helping improve productivity and safety in remote areas. Such innovations are expected to support market growth.

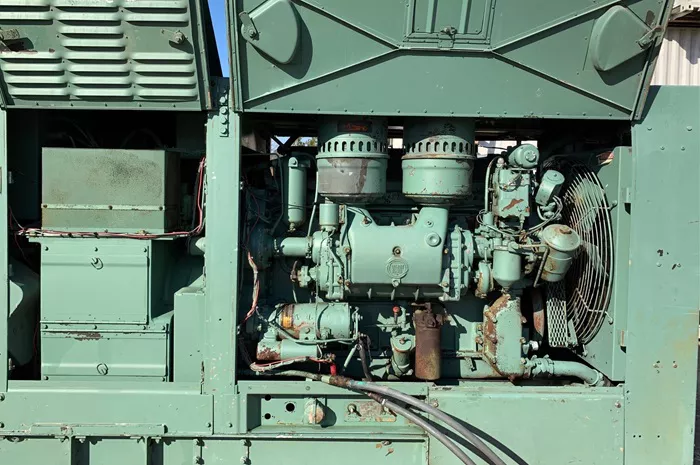

The market is divided by fuel type into diesel, natural gas, and hybrid or other fuels. The diesel segment is predicted to grow significantly. The rise in diesel engines for large tactical power systems is a major reason for this growth. For example, in November 2022, Cummins Inc. was chosen by the U.S. Department of Defense to develop and produce 500 kW generator sets for the Large Tactical Power System (LTPS) program.

However, natural gas has advantages during disasters or operations. It is supplied through underground, weatherproof pipelines and is widely available. It is also easier to store compared to diesel or gasoline. Diesel fuel can degrade if stored incorrectly, while natural gas can last indefinitely if contained properly. In 2019, natural gas generators made up 43% of the U.S. power generation capacity. Additionally, diesel generators contribute more to air pollution. Natural gas is a cleaner fuel, making it a more sustainable choice for backup power.

Several factors drive the growth of the military generator market. These include increased government defense spending, the development of small tactical generators, and technological improvements in diesel generators. On the other hand, strict emission regulations for diesel engines and the availability of alternative backup power solutions may limit market growth. Moreover, the rising use of DRASH tent systems and hybrid generators are expected to create new opportunities in the coming years.